Savvy Credit

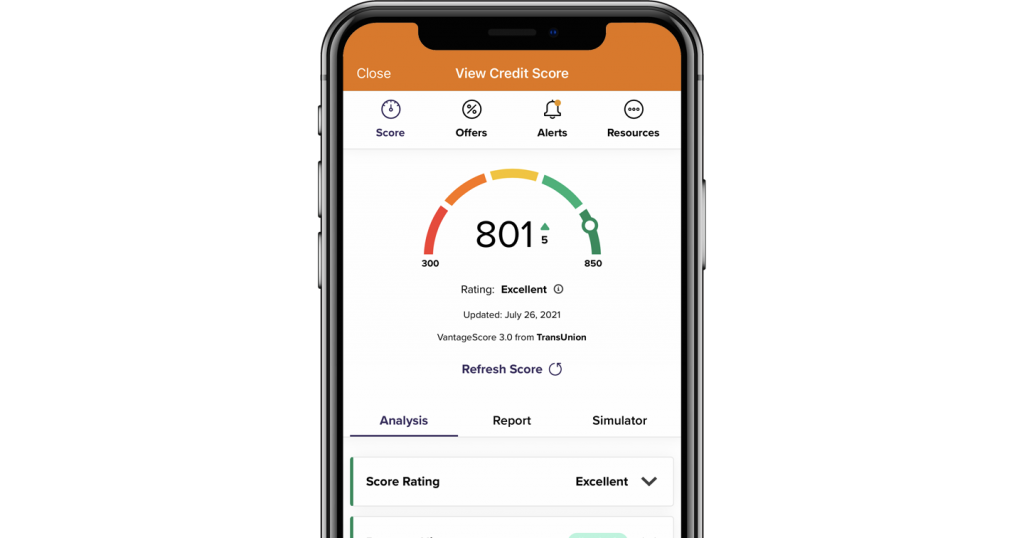

Take the mystery out of your credit score.

Savvy credit enables you to check your credit score in real time. Additionally, you’ll receive a personalized analysis of your score along with clear explanations of key determining factors.

Monitoring your credit score - big banking words. Let's uncomplicate them.

Monitoring your credit score - big banking words. Let's uncomplicate them.

Questions? We've got answers.

- Your credit score is an indicator of your financial responsibility. It can tell anyone who is going to lend you money how likely you are to pay back the loan.

- You are more likely to get approved for a loan if your credit score is high. Monitoring your credit score can help you improve it so you can get approved for loans you need.

- Signing up for a credit monitoring service like Savvy Credit can also help you create alerts should something change on your file. This helps lessen the harm from Identity Theft.

- Savvy credit can be accessed through Avidia Mobile Banking’s account summary page. Tap the “View Credit Score” link to start the enrollment process. This will not effect your credit score, nor is it an application for credit.

- Once enrollment is complete, you can check your credit score as well as your credit report*, which is updated monthly.

- Review your credit report monthly to catch any mistakes. 20% of all credit reports have mistakes.

- Automate payments to avoid late fees. 40% of your credit score is calculated from your payment history.

- Pay down debt and use between 10% – 30% of your available credit. Owing more than 30% of your credit limit can be a red flag to lenders.

- Use, (Yes use!) your credit card to make a small purchase once per month and immediately pay the bill. If you do not use your credit card, many creditors will cancel it after 6 months of inactivity and close the account, which can hurt your score.

Resources

- You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com

- To dispute an error on your credit report, contact both the credit reporting company and the company that provided the information.

- If you have been the victim of fraud, contact the nationwide credit reporting companies, you can place a fraud alert or security freeze on your credit report. You can also request that they block or remove fraudulent debts.

- Visit the Consumer Financial Protection Bureau for more information on any credit score or report topic.

THIS NOTICE IS REQUIRED BY LAW. Read more at FTC.gov.

You have the right to a free credit report from AnnualCreditReport.com or 877-322-8228, the only authorized source under federal law. Take me to the authorized source.