Personal Online Banking Upgrade

Our online banking platform got a makeover.

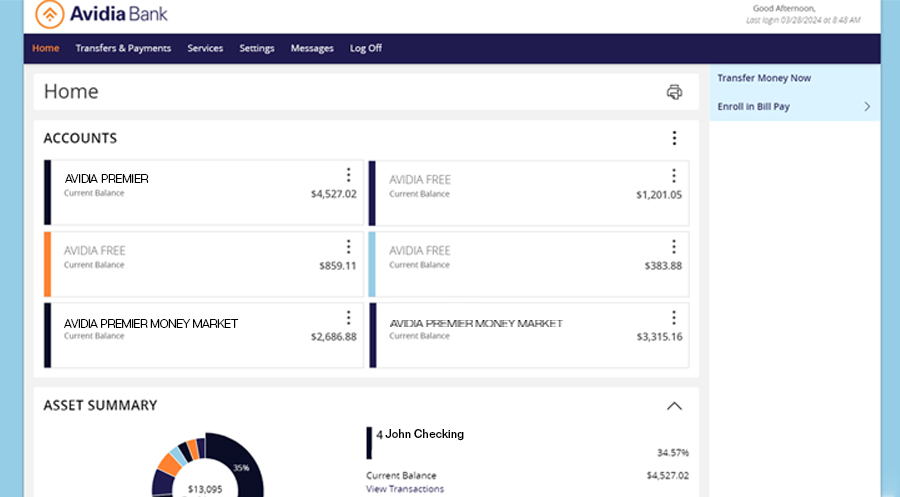

Our online banking and mobile banking experience has been upgraded with a new look and powerful features to give you more control and visibility into your finances. Review your monthly spending habits, get personalized saving suggestions, see all your accounts with the swipe of a finger, and so much more!

Your New Digital Banking Platform is Here!

Questions? Learn how to Login here.

Check out the new platform!

New Feature Alert: Card Controls and Alerts

Enhancements to card controls and alerts are almost here. Learn what you can do with these new, more powerful and customizable controls below. Access to manage card controls and alerts can be found in both mobile and online banking!

Control Purchases

Control where your card is used for purchases! Set controls to decline purchases by certain merchant type like online purchases, or gas station purchases.

Control Spending

Controls also allow you to set spending thresholds with the card meaning if the amount is over that limit the card is declined.

Purchase Alerts

Stay on top of purchases with alerts. You can choose to receive a text or email for all purchases or purchases at select merchants.

Frequently Asked Questions

You may login to the new online banking platform starting Monday, June 24th through the “Sign In” button on our website, using your current username and password. If you need assistance logging in, please watch this tutorial.

The new online banking platform is available here.

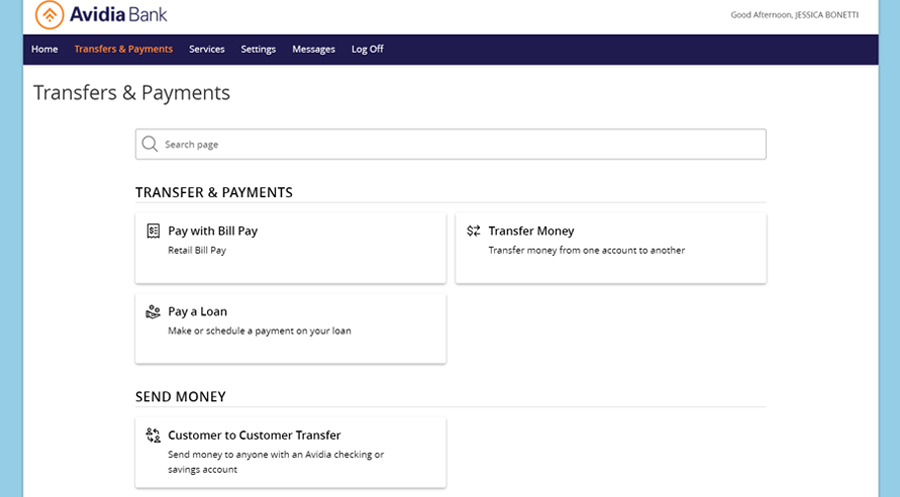

Yes! Starting June 24th, Pay a Person will be available in your new digital banking environment. This new P2P option provides you multiple options to retrieve your funds such as Venmo, PayPal and more! Enjoy the same great features and payment limits, but with more flexibility and access to funds.

Please note: You will need a debit card to utilize Pay a Person starting June 24th.

Starting June 24th, you can conveniently manage your debit card by simply using your mobile phone or online banking access. You will be able to set card controls for things like:

- Enable/Disable card

- Report a stolen card

- Reorder PIN

- Order a replacement card

- Set a travel notification

- Cancel travel notification

- Activate card (Tap to activate)

Starting Friday, June 21st:

- Any alerts or controls you currently have on your debit card will remain active.

- You will not be able to add, change, or delete alerts and controls within online

banking or the mobile app. - In order to add, change or delete alerts and controls, you can call us at 800-508-

2265. - A new way to add, change or delete alerts and controls is coming soon.

At first login you will be able to use your current User ID and Password. The system will then prompt you to enter a new Password.

You can reset your password by clicking “Forgot your password” on the sign-in page.

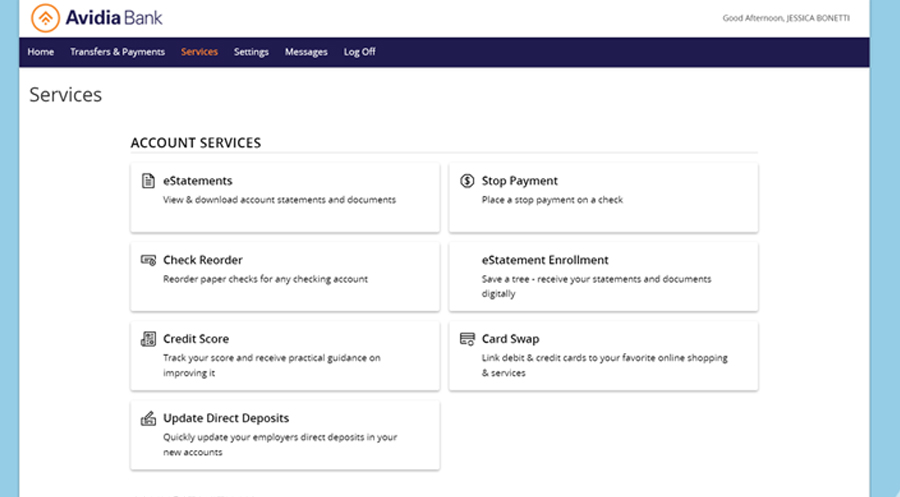

Once you are logged into your online banking account, click on setting at the top of the page. Scroll down to “preferences” and click “manage address and contacts”. You may update your information from there.

No, you will not need to re-enroll in online banking.

Yes, you will need to re-enroll in text banking. You can enroll by logging into your online banking portal, selecting “settings” and then selecting “text enrollment.”

No, you will not need to re-enroll in e-statements.

Our online banking platform was in need of an upgrade. We strive to make it easier to bank with us, and by upgrading your online banking and mobile app experience, we are doing that! You’ll have more control, power and visibility over your finances, and frankly – that’s pretty great.

Everything you could do before, and so much more! Check out our online tutorials of the new platform here.

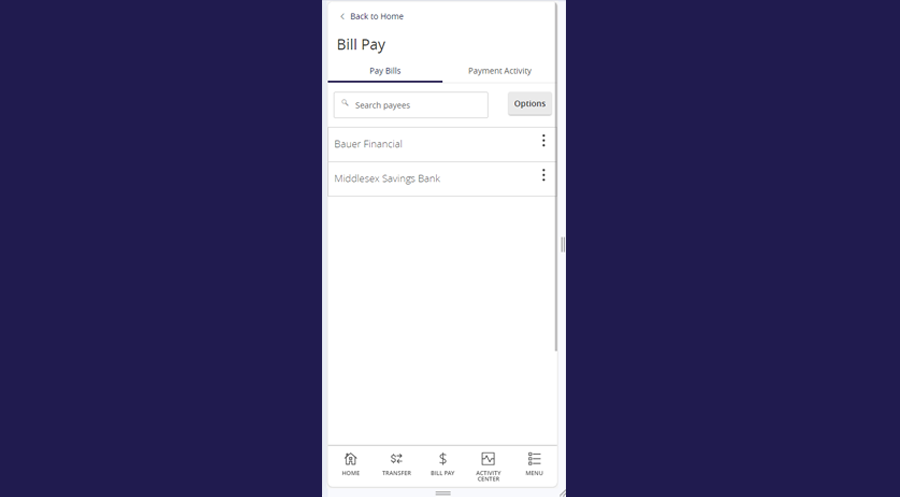

The features you love most about our current online banking platform, like Savvy Credit, Bill Pay, debit card controls, electronic statements and transaction options are staying the same!

Yes. Our wonderful customer care team or fantastic branch staff is available to help walk you through these changes. Visit a branch or call us at (800) 508-2265.

Yes, you will be able to see your transaction history back to March 2023.

TBD.

Yes, all scheduled transfers will not be interrupted with the upgrade.

Yes, your current bill pay information will remain the same. No need to re-enter information, unless you are adding a new bill payment vendor.

Yes, you can continue to make transfers between Avidia Bank accounts.

Yes, you can continue to make external transfers between your accounts not held at Avidia Bank.

Just like you do today, there will be a link on the site to access your reward points.

Yes, for added security after 30 minutes you be asked to sign back into online banking.

Your Money Insights is a powerful tool within your new online banking platform that uses your spending habits to deliver you personalized financial management information. This will be available within the online banking platform.

Android users will need to download a new app here. Apple users will simply need to update their current Avidia Bank mobile app.

The new mobile banking app is now available.

You can login to the new Avidia Bank mobile app with the same user ID and password your currently use for your Digital Banking. At first login you will be prompt to create a new password.

With the new Avidia Bank mobile app, at first login you will use your current User ID and Password. You will be prompt to change your password.

This is a code sent to your mobile device to authenticate your login credentials.

No. You may sign up for mobile banking independently of online banking.

Once you are logged into your mobile app, click on setting at the top of the page. Scroll down to “preferences” and click “manage address and contacts”.

Everything you can do on the desktop version, plus remote deposit capture!