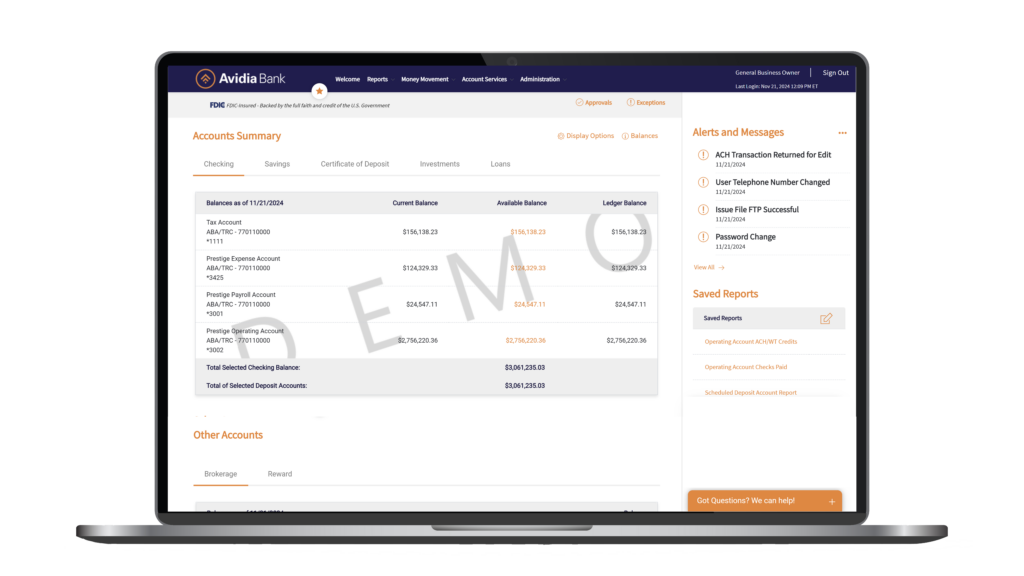

Online banking for businesses.

Ours is called Business Express Internet Banking.

The name’s a bit long. So just remember this: Online banking can happen anytime and anywhere. Got accounts and loans? Access them. Have bills to pay? Naturally. Take care of that online. Making a transfer, curious about the status of a check or need to place stop payment? It’s all here. Or wherever you are. You can even download account activity into QuickBooks and other financial programs. That’s just good business. Banking.

Interactive Demo

See what it’s all about.

Interactive Demo

See what it’s all about.

Customize your online banking experience

Depending on your needs, there are certain features you might use more often than others. Within Business Express Internet Banking, you’ll find additional modules that can be included in your regular rotation. Add-ons include:

- Wire transfers

- ACH origination

- Check and ACH Positive Pay

- Account reconciliation

- Bill pay

- Lockbox reports and images

- Deposit escrow sub account reporting

- eDeposit

- External transfers

- EDI reporting

Start doing your business banking online

Sign up Business Express Internet banking by calling 978-567-3552 or sending an email to [email protected].

Browsers and operating systems that support Business Express Internet Banking*

| Operating System | Safari | Internet Explorer | Microsoft Edge | Firefox | Google Chrome |

|---|---|---|---|---|---|

| Windows 7 64-bit | - | 10 or 11 | - | 49 or latest | 54 or latest |

| Windows 8.1 64-bit | - | 11 | - | 49 or latest | 54 or latest |

| Windows 10 32-bit | - | 11 | 25 or latest | 49 or latest | 54 or latest |

| Windows 10 64-bit | - | 11 | 25 or latest | 49 or latest | 54 or latest |

| macOS X 10.9 (MaverickTM ) | 9 | - | - | - | - |

| macOS X 10.10 (YosemiteTM) | 9 | - | - | - | - |

| macOS X 10.11 (El CapitanTM) | 9 | - | - | - | - |

Password Requirements for Business Express Internet Banking

Click here to view the requirements and security recommendations when creating a password for your online banking account.

*Other operating systems and browsers may be used. However, they are not supported and some features may not function properly. Issues identified for vendor non-supported versions may be beyond our control to address.